The claim is, if you purchased and squirreled away $1000 worth of 1986-87 Fleer Basketball waxboxes (you know, the one with the Michael Jordan RC) at the time of its initial release, it would be worth almost four times more than if you had taken that same $1000 and bought shares of Microsoft on the date of it's initial public offering on March 13th, 1986. The cards are (allegedly) worth $8.5 million vs. the stock which is worth around $2.25 million.

Now, if I were a little less sophisticated in the ways and means of The Hobby, this might make me consider taking that $1200 in Trump Bux most of us are about to receive and invest it in basketball cards -- the kind of cards, not coincidentally, some of the propagators of this meme just happen to have for sale. (Visa/MasterCard/PayPal accepted!)

This meme is false, dangerous, and not in the best interests of The Hobby.

Where to begin?

First, let's compare and contrast these two investments. Stock is, as they say, a liquid asset. If you had $2.25mm, if you had $1200, heck, if you had $1.49 burning a hole in your pocket right this second, you can buy shares in Microsoft. But because there's so much $MSFT on the market, your individual purchase really won't affect the stock's price one way of the other -- maybe a few pennies here or there if your order was large enough. Microsoft stock is there, it's available, and you can buy it right now if you so pleased.

You can not say the same about unopened 1986-87 Fleer Basketball (henceforth abbreviated as "86-87F BK") boxes.

$85,000 for a full, certified, unsearched, box of 86-87F BK is a probably a fair price in 2020 The last documented sale of a 86-87F BK box I could find was $75,000 during the 2017 National. But just because you bought 100 boxes of the stuff at $10/box 34 years ago, that does not mean you can easily convert that into $8.5mm cash. That is because Hobby wax (and not just 86-87F BK wax, but any and all wax) is not as liquid as Microsoft stock.

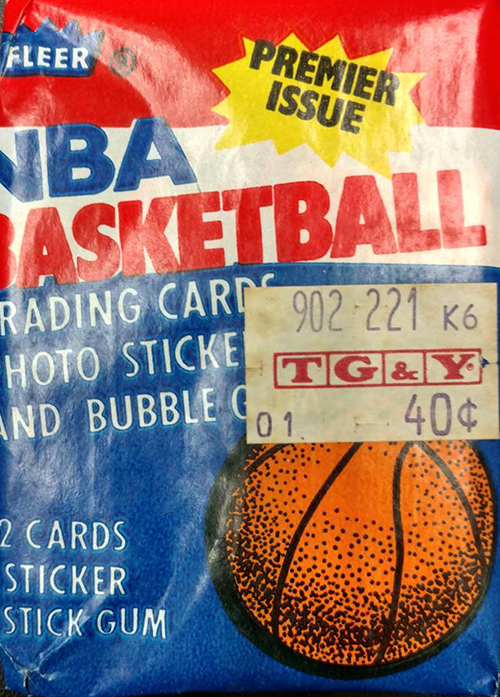

(Before I continue, I have a quibble with how the meme authors calculated the MSRP of 86-87F BK boxes. All of the packs discovered in the "TG&Y Find" were stamped with a $0.40 price tag. Since brick-and-mortar Hobby stores and weekly cardshows -- much less internet sales -- weren't as prevalent in 1986 as they would be just a few years later, let's assume that the vast majority of 86-87F BK was sold at mass-market retail outlets like TG&Y who charged the "sticker price" of $0.40/pack. Since you're buying retail, let's also assume that you live in a state that charges a sales tax and for ease of calculation let's make that tax 5%, YSMV. This works out to a retail price of $0.42 per pack.

(Before I continue, I have a quibble with how the meme authors calculated the MSRP of 86-87F BK boxes. All of the packs discovered in the "TG&Y Find" were stamped with a $0.40 price tag. Since brick-and-mortar Hobby stores and weekly cardshows -- much less internet sales -- weren't as prevalent in 1986 as they would be just a few years later, let's assume that the vast majority of 86-87F BK was sold at mass-market retail outlets like TG&Y who charged the "sticker price" of $0.40/pack. Since you're buying retail, let's also assume that you live in a state that charges a sales tax and for ease of calculation let's make that tax 5%, YSMV. This works out to a retail price of $0.42 per pack.That meant that, in 1986, if you wanted to buy a full 36-pack box, you're paying $15.12/box, and that your $1000 bankroll would have only bought 66 boxes. At a current market price of $85,000 each, those 66 boxes would have a value of only $5.6mm For purposes of this article, however, I will use the $10/box price and $85,000/box values cited in the meme.)

Unlike Microsoft stock, Raymond James, J.P. Morgan, and Goldman Sachs are not going to buy your 86-87F BK packs. Not every Hobby dealer has the available cash to buy an $85,000 box of cards. Not every Hobby dealer who has $85,000 cash on-hand would be interested on a box of cards. And not every card collector collects basketball cards. So the market in potential buyers for an $85,000 box is limited. 86-87F BK boxes are not as liquid as Microsoft stock.

You can probably count on one hand (and have a few digits left over) the number of 86-87F BK waxboxes that are available for purchase at any one time. And it is this unavailability, and not necessarily the scarcity (and don't get me wrong, these boxes are scarce), that makes 86-87F BK boxes so valuable.

If you were to unload 100 shares of Microsoft stock, it's not enough to move the market. If you found 100 sealed waxboxes of 86-87F BK in you're late Uncle Larry's storage container, congratulations! Unfortunately, you've just increased the available supply by a factor of five, ten, even twentyfold, should you decide to dump them all. Sorry, but you're not getting $8.5mm for Uncle Larry's stash. Not even close.

(Hypothetically speaking, if 100, or even 66, 86-87F BK boxes were to come on the market in one fell swoop, I think fair price would be in the $20,000 to $25,000 range, making those boxes worth ... around the value of $1000 worth of Microsoft stock at the time of its I.P.O.)

Look, everybody wants to make easy money. Everybody wants to get rich quick. We all dream of hitting the Powerball, or going on Antiques Roadshow and discovering that grandma's old ashtray is actually a priceless artifact, or that "find" in Uncle Larry's storage container. We all think our card collections are worth more than they're actually worth, and that those last few cards we need to finish that set really can't possibly cost as much as that dealer across the hall -- the only dealer in the hall that has your card -- is selling them for.

I'm old enough to remember The Junk Wax Era and I'm old enough to remember the mentality that drove The Hobby in this era. The mentality was, if a baseball card of Mickey Mantle from 1952 can sell for $5000 in 1987, surely all the hot rookies of 1987 will sell for just as much thirty-five years from now. (Anybody need 1000 87T Andres Galarraga RCs?) We all know how that turned out.

(Interestingly enough, 86-87F BK was the exception to this because in 1986, there was no such thing as a basketball card market. There was a reason there was a five-year gap between the final Topps-issued NBA set and 86-87F BK, reasons too many to list. Needless to say, Fleer did not print as much 86-87F BK as they did 1987 Fleer Baseball because: A) The lack of an established basketball card market, and B) the NBA itself was only beginning its Bird/Magic/Jordan-fueled takeoff in popularity. NBA Action: It's FAN-tastic!)

A generation later, and I see the same mentality infect The Hobby. Carnival barkers left and right whipping up the moneymarks into a Get-Rich-Quick frenzy. Step right up folks, and lemme tell you about a unique money making opportunity! It's shiny new basketball cards!

Thirty-five years ago, we saw the beginning of an era where much money was spent on cards by people who had little, if any, interest in actually collecting them. The last two-to-three years, we've seen a repeat of this. We know how this is going to end, and with COVID-19 prematurely hitting the stop button on pro sports and triggering a global depression, The Second Junk Wax Era may have just ended before our eyes.

But hey, did you know that you could have made four times as much investing in basketball cards than you could if you invested in Microsoft stock?

4 comments:

Uncle Larry!

Good stuff! I love posts like this one!

This 100%. People are hoarding the overflow (almost over production) of Zion rookies expecting Jordan RC results or better. Topps and Panini will flood out as many cards as they can as long as it sells.

We've seen this before, right?

Yes. Yes we have.

Post a Comment